Mr. Ankit Agarwal

(Director- Globe group of companies & Head - Globe wealth and Portfolio Management Service)

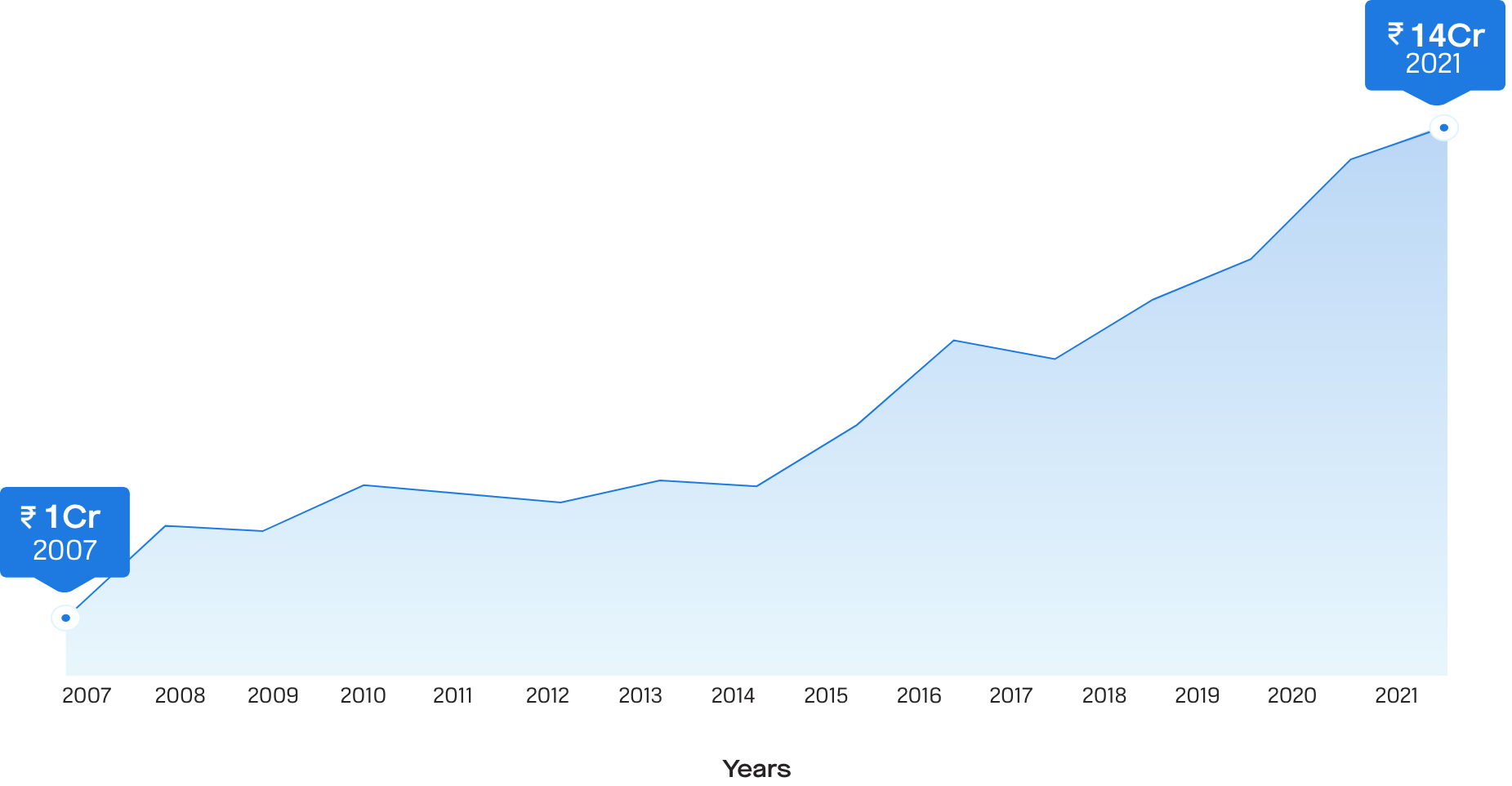

Ankit Agarwal is a Chartered Accountant and a CFA by qualification. He is in-charge of the overall Fund Management Division at Globe Capital including PMS, Investment Research, Institutional Investment Advisory and FII Advisory. He also heads the proprietary investment arbitrage division at Globe. Under his leadership in 2021 Globe PMS became the top performing fund in the 5 year CAGR category. He has a special acumen for value investing and identifying multibagger companies with good quality management.He has a great understanding and in-depth knowledge of Indian Capital Markets, Macro and Micro economic factors driving the economy. He also has expertise in special situation arbitrage and use of derivatives to make use of various opportunities in the market. He has initiated many investor education initiatives at various national forums for greater financial inclusion among the youth of this country.