- 15-May-2023

- Mutual Fund

Understanding Different Types of Mutual Funds and Their Risks – (Part 1)

It is Sunday, and you decide to treat yourself and your family to a Sunday buffet at a luxurious 5-star hotel. This would be your first-time experience of indulging in a buffet at such a prestigious establishment. Having heard from a friend about the incredible variety of mouth-watering dishes offered, you can’t help but feel excited.

As you step into the buffet area, you’re immediately greeted by the vibrant colours of the dishes displayed on each counter. The sight confirms the accuracy of your friend’s description, and you can’t wait to explore the culinary delights awaiting you. Holding the hands of your wife and child, you embark on a culinary adventure, moving from counter to counter, eager to sample each cuisine on offer – continental, Chinese, Indian, Thai, and so much more. The sheer array of options leaves you feeling a bit overwhelmed, wondering which dishes would make your plate selection truly worthwhile and make the most of the buffet experience you’ve paid for.

Interestingly, a similar scenario can be observed in India’s mutual fund industry. With a multitude of mutual funds available, each serving a specific purpose, it can be likened to the vast buffet spread. The Assets Under Management (AUM) of the Indian MF Industry has witnessed remarkable growth, increasing from ₹8.26 trillion as of April 30, 2013, to ₹41.62 trillion as of April 30, 2023, a more than five-fold increase over a span of ten years. (Source: AMFI)

Seeing this plethora of option available to an individual investor, we wish our readersto be aware of different types of mutual funds and their risks associated with them so that they can take informed decision.

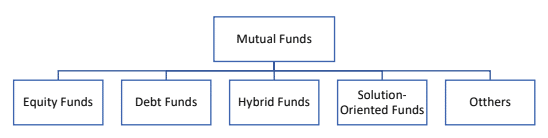

As per SEBI guidelines these are broad categories of mutual fund schemes–

Equity Funds: Equity funds primarily invest in equities and equity-related instruments. Their main objective is to seek long-term appreciation in value from the stock market. This category encompasses funds that invest in stocks of companies with varying market capitalizations, including large-cap, mid-cap, and small-cap funds. Furthermore, equity funds can be classified based on investment styles, such as value, growth, or dividend yield. These broad categories provide investors with different approaches to investing in equities.

10Sectoral/ ThematicInvest in theme and sectors. Minimum equity -80%11ELSSLock in of 3 years used to derive tax deduction under Section 80C. Minimum equity -80%

| Sr. No. | Equity Category | Scheme Characteristics | |

|---|---|---|---|

| 1 | Multi Cap Fund | Minimum investment in equity- 75% with a condition of minimum 25% in each category- large, mid and small stocks | |

| 2 | Flexi Cap Fund | Minimum investment in equity- 65% in any category – large, mid and small stocks | |

| 2 | Large Cap Fund | Minimum investment in large cap stocks- 80% | |

| 3 | Large & Mid Cap Fund | Minimum 35% in Large and 35% in mid cap companies | |

| 4 | Mid Cap Fund | Minimum investment in mid cap stocks- 65% | |

| 5 | Small Cap Fund | Minimum investment in small cap stocks- 65% | |

| 6 | Dividend Yield Fund | Invest in dividend yielding stocks. Minimum equity -65% | |

| 7 | Value Fund | Follow a value investment strategy. Minimum equity -65% | |

| 8 | Contra Fund | Follow a contrarian investment strategy. Minimum equity -65% | |

| 9 | Focused Fund | Maximum number of stocks to be held is 30. Minimum equity -65% |

Types of Risks in Equity Funds: Equity mutual funds can be excellent options for individuals with a holding period of more than 3 years. However, it’s important to be aware of the risks associated with these funds, as they primarily invest in the stock market. Here are a few of the risks to consider:

- Market Risk: Equity mutual funds are exposed to market risk, which means their performance is influenced by the overall stock market conditions in India. For example, during periods of market downturns or corrections, equity mutual funds can experience a decline in the value of their investments due to broader market trends.

- Volatility Risk: Volatility can be a friend or any enemy. Volatility can impact the value of equity mutual funds depending on their category and class of shares the scheme has invested in.

- Stock Selection Risk: The funds mentioned above are majorly active category of mutual funds.Active mutual fund requires humans to take active decision related to stock buying and selling. Thus, the performance of equity mutual funds relies on the fund manager’s ability to select stocks that will outperform the market and timely exits. Poor stock selection or the failure to identify promising investment opportunities can result in underperformance of the fund.

- Sector Risk: Equity mutual funds that focus on specific sectors are exposed to sector risk. For example, if a fund predominantly invests in the banking sector and there is a significant negative development or regulatory change impacting the banking industry, it can adversely affect the performance of the fund.

After understanding types of mutual fund risk related to equity funds, we have classified risk of each equity fund category for our readers convenience:

Equity Category Risk Profile Multi Cap Fund Moderate-High Risk Flexi Cap Fund Moderate-High Risk Large Cap Fund Moderate-High Risk Large & Mid Cap Fund Moderate-High Risk Mid Cap Fund High Risk Small Cap Fund High Risk Dividend Yield Fund Moderate Risk Value Fund High risk Contra Fund Moderate-High Risk Focused Fund Moderate-High Risk Sectoral/Thematic High risk ELSS Moderate-High Risk

We have covered the information related to equity funds. In Part 2, we will explore the remaining categories of mutual funds.