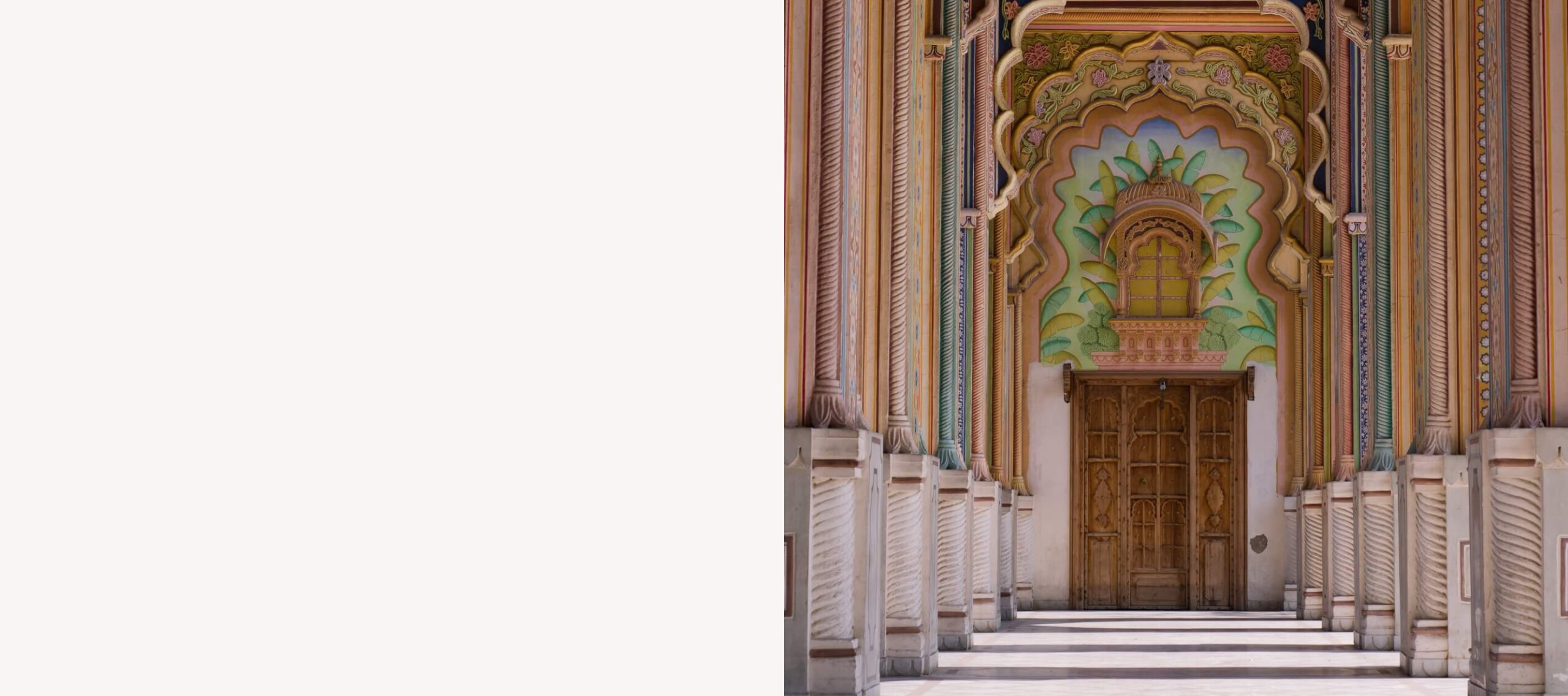

A Gateway to unlimited opportunities - India

Invest with India’s largest and most trusted clearing services

Globe is one of India's largest clearing services provider with a customer base of more than 1600 Institutional investors. With over three decades of experience, we clear and settle about high volume across asset classes, offering you the best clearing infrastructure!

Globe is amongst India’s largest financial services company and with our large retail & institutional customer base, we act as a one-stop shop for Foreign Portfolio Investors (FPI).

We offer algorithm trading platforms to Institutional, HFT, Proprietary Trading Groups, Buyside, Fund Managers and Fintech firms with Ultra Low-latency, High Frequency trading solutions and comprehensive Execution Algos, Care Order Management System, DMA, FIX Admin and other tools designed for institutional trading & risk management.

We offer Securities Lending & Borrowing Mechanism for foreign portfolio investors. Globe research tracks everyday opportunities in SLBM segment and helps customers generate additional income from an idle portfolio.

We have partnered with banks to offer PIS accounts for seamless operation of your broking account with Globe.

Trade in Equities, Derivatives, IPOs, Bonds & ETFs.

Invest in all that you need using one single trading app.

Figure out your returns based on your investments.

Free access to our regular reports, sector specific research &, company studies that will be available for you to make the right investing decisions.

Not everyone is a stock market wizard, so get free guidance at Globe Gurukul on equities, derivatives, mutual funds, futures, options and financial planning.

Simply call our toll free trading number and place, modify or cancel your orders instantly.